Track Record

Kings Road Capital is focused on junior natural resource companies. Although composition of the portfolio changes over time, an investor should be expecting a 65% exposure to precious metal equities and 35% to base metal equities. These equities cover a wide range from exploration, development, production and royalty companies.

The manager expects to provide absolute returns to the investors of the Fund. Having said that, commodities are volatile and cyclical. Hence, the equities that the Fund invests in will have times of negative headwinds at times. Kings Road Capital believes that through the project selection process and trading strategies employed, such headwinds can be negated in the medium to long term.

Since the Fund aspires to be the best diversified gold equity exposure alternative for investors, we assess our performance in both absolute and relative terms. Below is the graph displaying our 10-year track record in absolute terms; and in comparison, to the S&P TSX Venture Materials index (converted to US$).

Risk Measures and Benchmark Comparison

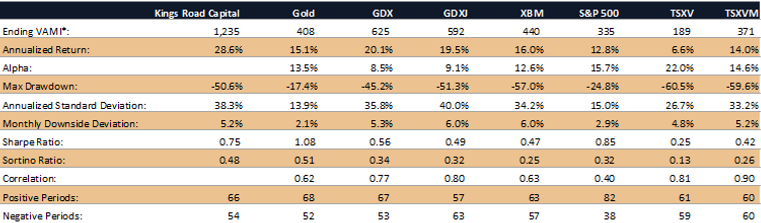

Below is a table displaying our 9-year track record in comparison to: i) Gold, ii) GDX, VanEck Vectors Gold Miner ETF, iii) GDXJ, VanEck Vectors Junior Gold Miner ETF, iv) XBT, the iShares S&P/TSX Global Base Metals Index ETF, v) the S&P 500 and vi) TSXV, TSX Venture exchange in Canada, and vii) S&P TSX Venture Materials Index. We converted non-US$ indices to US$ for comparison purposes. It is worth highlighting that our superior returns were achieved with a lower downside deviation than all the mining specific ETFs and indices below.

*VAMI stands for Value Added Monthly Index of a hypothetical investment of a 100 from 1 January 2016.

Monthly Returns

Conclusion

Although past performance is never a guarantee for future returns, we at Kings Road Capital, regard our in-depth sector knowledge along with our trading approach as a competititive edge giving us a strong likelihood to continue creating alpha (i.e. excess returns vs. benchmarks) in the long run.